We have a range of support services in place to make sure that your time at college is the best it can be!

Guidance and Attendance

Our Guidance and Attendance teams are available across all five Fife College campuses and are dedicated to supporting you in any way possible

Learn More

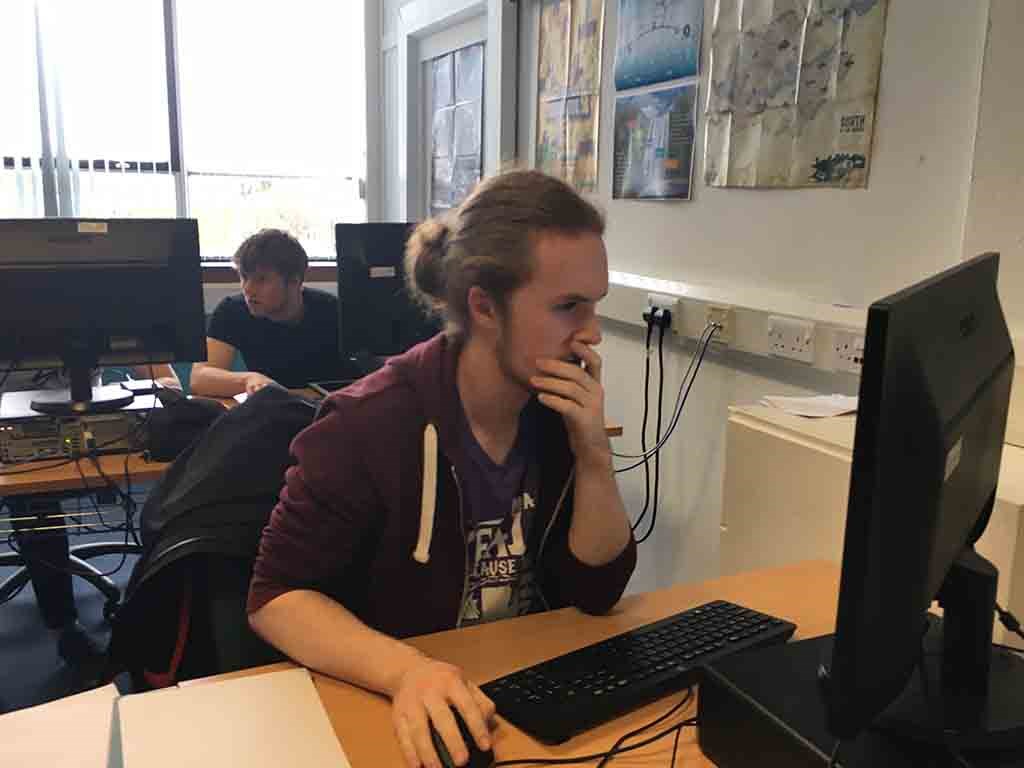

Inclusion Team

Everyone is entitled to take part in learning and to realise their own potential

Learn More

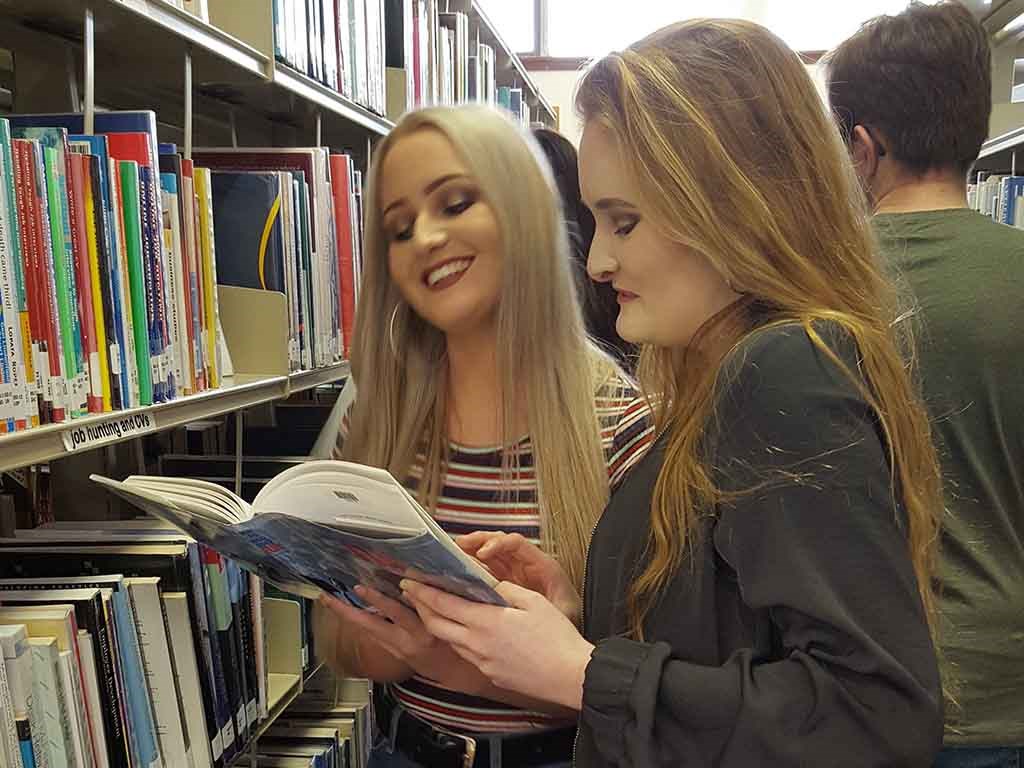

Libraries

Our well-resourced libraries, with dedicated study spaces, are the perfect place to find out what you need for your research or simply to find a quiet place to write up a report, read a textbook, or use a computer

Learn More

Student Employability Team

Ensuring career development is an integral part of your time at college.

Learn More